Unter Strategiemanagement verstehen wir die Planung, Umsetzung und Weiterentwicklung längerfristig gültiger strategischer Ziele für Unternehmen und Organisationen zur Erreichung und nachhaltigen Sicherung dieser Ziele.

|

Für den schnellen Leser: Das Ergebnis der theoretischen Strategieforschung fassen wir mit Markowitz zusammen: Es gibt keine, nur von außen gesteuerte Strategie, die wie "das Manna vom Himmel fällt", genau so wenig, wie es erfolgreiche, rein geplante Strategien gibt. Erfolgreiche Strategien befinden sich immer in einem gleitenden Kontinuum zwischen geplanten und emergenten Situationen. Ohne einen emergenten Anteil im Strategiemanagement kann es kein strategisches Lernen geben. Das ist aber die Voraussetzung dafür, nachhaltig am Markt bestehen zu können. Empirisch belegt Markowitz, dass etwa 2/3 von rein geplanten Strategien scheitern oder gar nicht erst umgesetzt werden. Die Steinbeis Erfahrung zeigt, dass gerade erfolgreiche Mittelständler immer einen hohen Anteil an emergenten Strategien haben. Man könnte auch salopp sagen: Sie reagieren schneller auf Marktveränderungen.

|

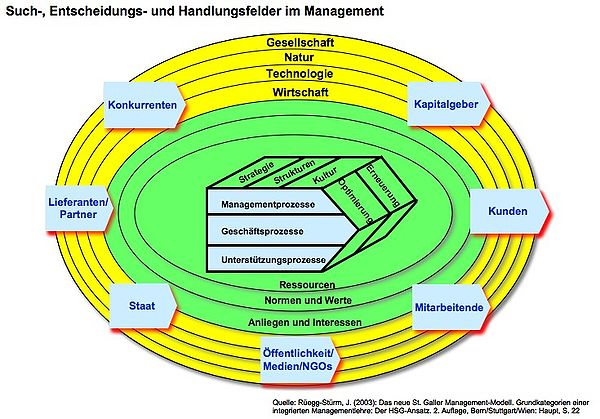

Wir ordnen das strategische Management in die drei ebenen des Managmentmodells der Universität St. Gallen ein.

Quelle: https://de.wikipedia.org/wiki/St._Galler_Management-Modell

Normatives Management

Als normatives Management wird die oberste der drei Managementebenen des St. Galler Management-Modells bezeichnet.

Diese Ebene „beschäftigt sich mit den generellen Zielen der Unternehmung, mit Prinzipien, Normen und Spielregeln, die darauf ausgerichtet sind, die Lebens- und Entwicklungsfähigkeit der Unternehmung zu ermöglichen.“

Dabei geht es vor allem in einer Erweiterung des engen, US-amerikanischen shareholder-Ansatzes um die ethische Legitimation der unternehmerischen Tätigkeit angesichts der Anliegen und Interessen der verschiedenen Anspruchsgruppen an das Unternehmen (Stakeholder). Als Stakeholder bezeichnet man das Umfeld, das Ansprüche an ein Unternehmen stelltn oder auch nur Interesse am Verlauf der unternehmerischen Aktivitäten entfaltet. Dies sind im engeren Sinne: Eigentümer, Manager und Mitarbeiter. im weiteren Sinne aber auch: Künden, Lieferanten, Gläubiger und der Staat, die Gesellschaft, also das gesamte Umfeld um das Unternehmen.

Auf der normativen Managementebene legt eine Organisation ihre Unternehmenspolitik, Leitsätze/Leitlinien, Grundsätze und Unternehmensstandards fest.

Strategisches Management

Das strategische Management ist die mittlere der drei Managementebenen des St. Galler Management-Modells. Auf der strategischen Managementebene entwickelt eine Organisation Vorgehensweisen, um seine im normativen Management definierten Leitsätze zu verfolgen und Ziele zu erreichen. Solche Geschäftsstrategien werden beispielsweise in einem Geschäftsplan formuliert und in einer Strategy-Map dargestellt. Das Ziel ist die Etablierung langfristiger Wettbewerbsvorteile durch eine im Vergleich zur Konkurrenz überlegene Grundkonfiguration der Unternehmung. Es gilt Alleinstellungsmerkmale zu formulieren, konkret zu erreichen und nachhaltig aufrecht zu erhalten. Ein Blick in eine gute Strategy Map muss klar erkennen lassen, wo die Alleinstellungsmerkmale des Unternehmen im Vergleich zu den Wettbewerbern liegen.auf einen

Die Umsetzung der Strategien obliegt dem operativen Management.

Operatives Management

Die unterste der drei Managementebenen des St. Galler Management-Modells ist das operative Management. Es umfasst Prozesse der Mitarbeiterführung, der finanziellen Führung und des Qualitätsmanagements.

Wir teilen das operative Management ein in die

- Führungsfunktionen des Managements

- Kernfunktionen des Managements (Die Steuerung der eigentlichen Leistungsprozesse zur Erstellung von Produken oder Dienstleistungen)

- Hilfs-oder Unterstützungsfunktionen des Managements

Hier werden die groben Inhalte, die im strategischen Entwicklungsprozess erarbeitet wurden, im unmittelbaren Alltagsgeschehen trotz unvorhergesehener Störungen umgesetzt. Die Strategie bildet die Leitplanken, innerhalb derer Entscheide auf operativer Ebene gefällt werden.

Auf der operativen Managementebene einer Organisation erfolgen die Führung der Mitarbeiter und/oder der Nachunternehmen, die Bereitstellung der Mittel (Ressourcen) sowie die Planung, Steuerung und Überwachung der Geschäftsprozesse. Die operative Planung setzt bestimmte Vorgaben um. Sie ist kurzfristig angelegt und ihre Dauer umfasst bis zu einem Jahr. Sie ist detailliert, relativ genau und enthält alle Einzelziele.

Das operative Management betreut auch den sozialen Aspekt des Mitarbeiterverhaltens, welcher im kooperativen Verhalten, sowie in der vertikalen und horizontalen Kommunikation eine Rolle spielt.

In seiner vierten Generation wurde das Modell um die Perspektive Management-Innovation ergänzt.

Diesen Ansatz verfolgen wir, indem wir dem Innovationsmanagement besondere Aufmerksamkeit entgegenbringen

Im SGMM der vierten Generation plädieren die Autoren für systematische Anstrengungen zur Weiterentwicklung einer historisch gewachsenen und damit oft einer starren Management-Praxis. Diese Reflexion kann nach Auffassung des Modells aber nur kollektiv, das heißt mittels gezielter Kommunikationsprozesse geleistet werden. Voraussetzung der Management-Innovation ist es deshalb, eine gemeinsame Management-Sprache zu entwickeln und Innovationspartnerschaften zu bilden, welche beispielsweise aus der Zusammenarbeit von Praxis und Forschung hervorgehen können.

Um ein strategisches Management effizient und effektiv umzusetzen und nachhaltig auf Erfolgskurs zu halten, sind folgende Unterscheidungen und Handlungsempfehlungen sinnvoll:

- Unter Strategie versteht man dabei die längerfristige Ausrichtung eines Unternehmens, dessen Geschäftsziele aus Vision und Mission entwickelt sind und das mit dieser Strategie erkennbare Alleinstellungsmerkmale für die ausgewählten Märkte erzielen und nachhaltig sichern will. Salopp formuliert muss eine gute Strategie auf einen Blick erkennen lassen, wie das Unternehmen im Wettbewerb nachhaltig Geld verdienen will.

- Dazu müssen Führung (Governance) und die Aufbau- und Ablauforganisation des Unternehmens auf die Strategie ausgerichtet sein.

- Die Infrastruktur und die Ressourcen des Unternehmens in Form der Human-, Technical-, Information- und Financial Ressources als notwendige Inputs zur Umsetzung und permanenten Weiterentwicklung müssen nachhaltig entwickelt und gesichert werden.

- Schließlich sind im Sinne eines systematischen PDCA-Zyklus auf Best-Practice Niveau die notwendigen Regelschleifen und Lernprozesse zu etablieren.

Managementwerkzeuge, Informations- und Anreizsysteme sind dazu unser Beitrag zur Zielerreichung.

Wir verwenden übliche Analysewerkzeuge zur Strategiefindung, zur Evaluation von Strategien und zur Erneuerung und Aktualisierung vorhandener Strategien oder von Strategieskeletten. Hervorzuheben sind SWOT-Analyse, das OAS-Framework von Kaplan/Norton und Mehrfelder-Matrizen (BCG, McKinsey, ADL, u.a.). In Workshops hat sich zur Ideenfindung, zur Systematisierung und zur Visualisierung das Business Modelling (Business Model Canvas nach Osterwalder) bestens bewährt.

Schauen Sie sich doch einmal hier ein Interview mit Michael Porter zu seinem Fife Forces Modell an!

>zum Youtube Video "Interview mit Michael Porter zu seinem Fife Forces Modell"

Ein sehr gut gemachtes Youtube Webinar zum Fife Forces Modell stellen wir Ihnen hier zur Verfügung:

> zum Youtube Webinar der Hoogeschool van Amsterdam "Michael Porter's Fife Forces Model Explained"

Wir nutzen dann, wenn die Strategie gefunden, committet und gefestigt ist, zur Umsetzung die Balanced Scorecard Methode in Ihrer vierten Generation, indem wir Strategy Map(s), Ziele, Indikatoren, Projekte und Aktivitäten präzise formulieren und durch geeignete Messmethoden für das Management steuerbar gestalten. Eine Meilensteinplanung ist dabei sehr hilfreich und macht Ergebnisse greifbarer. Auf diese Weise wird die Strategie auch umgesetzt.

Selbstverständlich ist in Unternehmen und Organisationen, die einen hohen Reifegrad in ihrem Management erreichen wollen, dass diese Prozesse reproduzierbar formuliert sind und mit geeigneten Analyse- und Lernschleifen ständig weiterentwickelt werden. Im höchsten Reifegrad unterscheiden wir dabei "best-in-class" Niveaus und das absolute "best- practices" Niveau.

Die Zeithorizonte im strategischen Management umfassen in der Regel zwei bis fünf Jahre, wobei strategisch nicht mit längerfristig gleichzusetzen ist, strategische Pläne aber meistens einen längerfristigen Zeithorizont haben. Aufgrund der starken Überschneidung des Themas mit Fragen der Produktpolitik, des Marketings und der Bedeutung für die Stakeholder des Unternehmens korrespondiert das strategische Management stark mit dem Begriff der Unternehmensführung. Im St. Galler Management-Modell kann man gut erkennen, wie das strategische Management mit den anderen Bereichen des Managements zusammenwirkt.

Hilfsmittel zur Entwicklung von Geschäftsmodellen:

Mit dem Begriff Geschäftsmodell liegt man recht nahe an unserer zentralen Forderung nach einer klaren, schriftlich formulierten und immer wieder zu hinterfragenden Unternehmenstrategie. Dennnoch stoßen wir in der Praxis leider oft auf Unklarheit über eine allgemeingültige Definition und die nötigen Bestandteile.

Obendrein ist es schwer, ein Geschäftsmodell rein mit Worten zu beschreiben, weil ja letztlich mit Strategie der Wunsch des Managements verbunden ist, so gut zu sein, dass man die Konkurrenz am Markt schlagen kann. Es wäre also besser, die Strategie bzw. das Geschäftsmodell wie einen Bauplan von Architekten zusammen mit einem breiten Team des Managements zu entwerfen, zu diskutieren und sich zur Umsetzung zu entscheiden.

Das von Alexander Osterwalder entworfene Tool zur Visualisierung von Geschäftsmodellen (The Business Model Canvas) greift diese Vorstellung auf und wird von uns gerne in dieser Art oder auf die Fragestellung abgewandelt vorwiegend in Verbindung mit Workshops verwendet.

Die von ihm entwickelte Vorlage "Business Model Canvas" ist ein strategisches Managementinstrument, das uns ermöglicht, neue oder bestehende Geschäftsmodelle zu entwickeln und zu skizzieren.

Wenn wir ein solches Modell entwickeln, wählen wir gerne die bewährte Metaplantechnik. Im Workshop werden an großen Wandtapeten oder Papieren mit Klebekärtchen, Post-Its, Filzstiften, Klebestiften und allem, was die Kreativität fördert, die Business Modelle entworfen.

Auf Anfrage stellen wir Ihnen auch ein selbst entwickeltes Google Formular zur Verfügung.

Sehr innovativ ist die Steinbeis ePen Lösung, wobei Ihre Arbeiten und Notizen, die Sie auf das Wandpapier schreiben, direkt per Bluetooth oder remote via Internet an die angeschlossenen Rechner überspielt werden.

__________________________

Business Model Canvas: Online business model building blocks, Osterwalder, Pigneur & al. 2010

The Business Model Canvas is a strategic management template for developing new or documenting existing business models. It is a visual chart with elements describing a firm's value proposition, infrastructure, customers, and finances.[1] It assists firms in aligning their activities by illustrating potential trade-offs.

The Business Model Canvas was initially proposed by Alexander Osterwalder[2] based on his earlier work on Business Model Ontology.[3] Since the release of Osterwalder's work in 2008, new canvases for specific niches have appeared, such as the SaaS Canvas.

The Business Model Canvas

Formal descriptions of the business become the building blocks for its activities. Many different business conceptualizations exist; Osterwalder's work and thesis propose a single reference model based on the similarities of a wide range of business model conceptualizations. With his business model design template, an enterprise can easily describe their business model.

Infrastructure

Key Activities: The most important activities in executing a company's value proposition. An example for Bic would be creating an efficient supply chain to drive down costs.

Key Resources: The resources that are necessary to create value for the customer. They are considered an asset to a company, which are needed in order to sustain and support the business. These resources could be human, financial, physical and intellectual.

Partner Network: In order to optimize operations and reduce risks of a business model, organization usually cultivate buyer-supplier relationships so they can focus on their core activity. Complementary business alliances also can be considered through joint ventures, strategic alliances between competitors or non-competitors.

Offering

Value Proposition: The collection of products and services a business offers to meet the needs of its customers. According to Osterwalder, a company's value proposition is what distinguishes itself from its competitors. The value proposition provides value through various elements such as newness, performance, customization, "getting the job done", design, brand/status, price, cost reduction, risk reduction, accessibility, and convenience/usability.

- The value propositions may be:

- Quantitative- price and efficiency

- Qualitative- overall customer experience and outcome

Customers

Customer Segments: To build an effective business model, a company must identify which customers it tries to serve. Various set of customers can be segmented based on the different needs and attributes to ensure appropriate implementation of corporate strategy meets the characteristics of selected group of clients. The different types of customer segments include:

- Mass Market: There is no specific segmentation for a company that follows the Mass Market element as the organization displays a wide view of potential clients.

- Niche Market: Customer segmentation based on specialized needs and characteristics of its clients.

- Segmented: A company applies additional segmentation within existing customer segment. In the segmented situation, the business may further distinguish its clients based on gender, age, and/or income.

- Diversify: A business serves multiple customer segments with different needs and characteristics.

- Multi-Sided Platform / Market: For a smooth day to day business operation, some companies will serve mutually dependent customer segment. A credit card company will provide services to credit card holders while simultaneously assisting merchants who accept those credit cards.

Channels: A company can deliver its value proposition to its targeted customers through different channels. Effective channels will distribute a company’s value proposition in ways that are fast, efficient and cost effective. An organization can reach its clients either through its own channels (store front), partner channels (major distributors), or a combination of both.

Customer Relationship: To ensure the survival and success of any businesses, companies must identify the type of relationship they want to create with their customer segments. Various forms of customer relationships include:

- Personal Assistance: Assistance in a form of employee-customer interaction. Such assistance is performed either during sales, after sales, and/or both.

- Dedicated Personal Assistance: The most intimate and hands on personal assistance where a sales representative is assigned to handle all the needs and questions of a special set of clients.

- Self Service: The type of relationship that translates from the indirect interaction between the company and the clients. Here, an organization provides the tools needed for the customers to serve themselves easily and effectively.

- Automated Services: A system similar to self-service but more personalized as it has the ability to identify individual customers and his/her preferences. An example of this would be Amazon.com making book suggestion based on the characteristics of the previous book purchased.

- Communities: Creating a community allows for a direct interaction among different clients and the company. The community platform produces a scenario where knowledge can be shared and problems are solved between different clients.

- Co-creation: A personal relationship is created through the customer’s direct input in the final outcome of the company’s products/services.

Finances

Cost Structure: This describes the most important monetary consequences while operating under different business models. A company's DOC.

- Classes of Business Structures:

- Cost-Driven - This business model focuses on minimizing all costs and having no frills. i.e. SouthWest

- Value-Driven - Less concerned with cost, this business model focuses on creating value for their products and services. i.e. Louis Vuitton, Rolex

- Characteristics of Cost Structures:

- Fixed Costs - Costs are unchanged across different applications. i.e. salary, rent

- Variable Costs - These costs vary depending on the amount of production of goods or services. i.e. music festivals

- Economies of Scale - Costs go down as the amount of good are ordered or produced.

- Economies of Scope - Costs go down due to incorporating other businesses which have a direct relation to the original product.

Revenue Streams: The way a company makes income from each customer segment. Several ways to generate a revenue stream:

- Asset Sale - (the most common type) Selling ownership rights to a physical good. i.e. Wal-Mart

- Usage Fee - Money generated from the use of a particular service i.e. UPS

- Subscription Fees - Revenue generated by selling a continuous service. i.e. Netflix

- Lending/Leasing/Renting - Giving exclusive right to an asset for a particular period of time. i.e. Leasing a Car

- Licensing - Revenue generated from charging for the use of a protected intellectual property.

- Brokerage Fees - Revenue generated from an intermediate service between 2 parties. i.e.Broker selling a house for commission

- Advertising - Revenue generated from charging fees for product advertising.

Application

The Business Model Canvas can be printed out on a large surface so groups of people can jointly start sketching and discussing business model elements with post-it note notes or board markers. It is a hands-on tool that fosters understanding, discussion, creativity, and analysis.

-----------------------------------------------------

Hier einige weiterführende englischsprachige Ausführungern, die wir für so interessant halten, dass wir diese hier auszugsweise zitieren:

(Quelle: http://en.wikipedia.org/wiki/Business_strategy; http://en.wikipedia.org/wiki/Strategic_management)

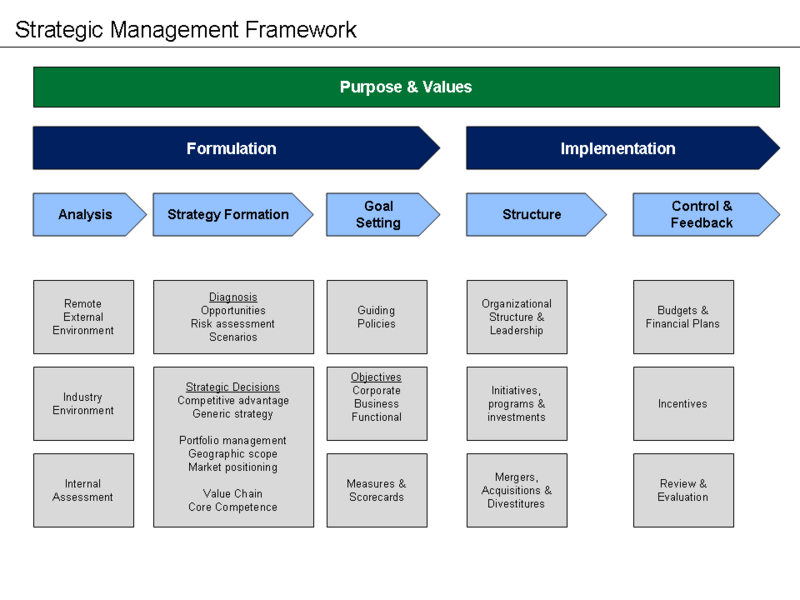

Quelle der Abbildung: http://en.wikipedia.org/wiki/Strategic_management#mediaviewer/File:Strategic_Management_Framework.png

Strategic management is a level of managerial activity below setting goals and above tactics. Strategic management provides overall direction to the enterprise and is closely related to the field of Organization Studies. In the field of business administration it is useful to talk about "strategic consistency" between the organization and its environment or "strategic consistency." According to Arieu "there is strategic consistency when the actions of an organization are consistent with the expectations of management, and these in turn are with the market and the context."

"Strategic management is an ongoing process that evaluates and controls the business and the industries in which the company is involved; assesses its competitors and sets goals and strategies to meet all existing and potential competitors; and then reassesses each strategy annually or quarterly [i.e. regularly] to determine how it has been implemented and whether it has succeeded or needs replacement by a new strategy to meet changed circumstances, new technology, new competitors, a new economic environment., or a new social, financial, or political environment." Strategic Management can also be defined as "the identification of the purpose of the organisation and the plans and actions to achieve the purpose. It is that set of managerial decisions and actions that determine the long term performance of a business enterprise. It involves formulating and implementing strategies that will help in aligning the organization and its environment to achieve organisational goals."

Concepts/approaches of strategic management

Strategic management can depend upon the size of an organization, and the proclivity to change of its business environment. These points are highlighted below:

A global/transnational organization may employ a more structured strategic management model, due to its size, scope of operations, and need to encompass stakeholder views and requirements.

An SME (Small and Medium Enterprise) may employ an entrepreneurial approach. This is due to its comparatively smaller size and scope of operations, as well as possessing fewer resources. An SME's CEO (or general top management) may simply outline a mission, and pursue all activities under that mission.

Whittington (2001) highlighted four approaches to strategic management. These are Classical, Processual, Evolutionary and Systemic approaches.

Mintzberg stated there are prescriptive (what should be) and descriptive (what is) approaches. Prescriptive schools are "one size fits all" approaches that designate "best practice" while descriptive schools describe how strategy is implemented in specific contexts.

No single strategic managerial method dominates, and remains a subjective and context-dependent process.

Strategy formation (Classical school)

The initial task in strategic management is typically the compilation and dissemination of the vision and the mission statement. This outlines, in essence, the raison d'etre of an organization. Additionally, it specifies the organization's scope of activities and the markets a firm wishes to serve.

Follow-on strategy formation is a combination of three main processes which are as follows:

Performing a situation analysis, self-evaluation and competitor analysis: both internal and external; both micro-environmental and macro-environmental.[clarification needed]

Concurrent with this assessment, short- and long-term objectives are set. These objectives should include completion dates.

Implementation plans then detail how the objectives are to be achieved.

Strategy evaluation and choice

An environmental scan will highlight all pertinent aspects that affect an organization, whether external or sector/industry-based. Such an occurrence will also uncover areas to capitalise on, in addition to areas in which expansion may be unwise.

These options, once identified, have to be vetted and screened by an organization. In addition to ascertaining the suitability, feasibility and acceptability of an option, the actual modes of progress have to be determined. These pertain to:

The basis of competition

Companies derive competitive advantage from how an organization produces its products, how it acts within a market relative to its competitors, or other aspects of the business. Specific approaches may include:

Differentiation, in which products compete by offering a unique combination of features.

Cost, in which products compete to offer an acceptable list of features at the lowest possible cost.

Segmentation, in which products are tailored for the unique needs of a specific market, instead of trying to serve all consumers.

Suitability

Suitability deals with the overall rationale of the strategy.

Does the strategy address the mission?

Does it reflect the organization's capabilities?

Does it make economic sense?

Evaluation tools include strength, weakness, opportunity, threat (SWOT) analysis.

Feasibility

Feasibility is concerned with whether the organization has the resources required to implement the strategy. Resources include capital, people, time, market access and expertise.

Evaluation tools include :

- cash flow analysis and forecasting

- break-even analysis

- resource deployment analysis

this has to be inline with demand forecasting.

Acceptability

Acceptability is concerned with the expectations of the identified stakeholders (shareholders, employees and customers, etc.) with the expected financial and non-financial outcomes. Return deals with stakeholder benefits. Risk deals with the probability and consequences of failure. Employees are particularly likely to have concerns about non-financial issues such as working conditions and outsourcing.

Evaluation tools include:

- what-if analysis

- stakeholder mapping

Implementation

While products and services that fit the strategy may receive additional investment, those that don't must also be addressed, either via consolidation with another product/service, divestment to another firm, immediate retirement or harvesting without further investment.

Additionally, the exact means of implementing a strategy needs to be considered. These points range from:

- Alliances with other firms to fill capability/technology/legal gaps

- Investment in internal development

- Mergers/acquisitions of products or firms to reduce time to market

Countries such as India and China require market entrants to operate via partnerships with local firms.

Strategic implementation and control

Implementing a strategy involves organising, resourcing and employing change management procedures.

Organizing

Implementing a strategy may require organizational changes, such as creating new units, merging existing ones or even switching from a geographical structure to a functional one or vice versa. Organizing also involves bringing together factors and arranging them in the preferred order and also setting things straight.'

Resourcing

Implementation may require significant budget shifts, impacting human resources and capital expenditure.

Change management

Implementing a strategy may have effects that ripple across an organization. Minimizing disruption can reduce costs and save time. One approach is to appoint an individual to champion the changes, address and eventually enlist opponents and proactively identify and mitigate problems.

Alignment

In 2010 the Rotterdam School of Management together with the Erasmus School of Economics introduced the S-ray Alignment Scan, which is a visual representation of strategy measured against the level of understanding and implementation of various parts of the organization. In 2011 Erasmus University of Rotterdam introduced S-ray Diagnostics, a spin-off of this cooperation, focused on measuring strategic alignment of organizations.

Whittington's perspectives

Whittington outlined three other approaches to strategic management thinking. They have in common responsiveness to factors other than the profit maximization and market position goals of the classic approach.

Processual

With the advent of stagflation in the 1970s, rising trade union actions in some countries, wide-scale regional conflicts, rising oil prices, etc., strategy development began to explicitly consider stakeholders other than the firm's executives. Objections by other stakeholders could obstruct or even prevent implementation.

Processual strategic management incorporates steps to manage/resolve such conflicts via negotiation and compromise. Processual strategic management also emphasised negotiation since business environments became enriched with disagreement, conflict and contention. In this context, a rational approach (as per the classical school) could not be implemented without acknowledgment and incorporation of different and disparate viewpoints.

Evolutionary

Evolutionary strategic management attempts to accelerate strategy development by breaking it into multiple smaller changes, with ongoing review enabling more rapid adjustments to the original plan. A major facet of evolutionary strategic management is a population ecology model, in which firms in an industry are seen akin to a population of animals.[clarification needed]

For some firms, the business environment including technology, finance and regulation change too quickly and unpredictably for multi-year planning processes to address effectively. Evolutionary approaches, while not optimal for a particular environment, allowed the organization greater flexibility to adapt to unexpected change.

The evolutionary school became prominent in the 1980s, coupled with the emergence of Information and Communications Technology into mainstream business operations and society at large, and global events such as the end of the Cold War. Due to the rise of a more complex business environment, firms could not afford to plan rationally, but "adapt or die" in an almost Darwinian sense. The school is termed 'evolutionary' with respect to its resemblance to classical Darwinian theory, and the application of zoologically-derived population ecology models to business environments.

Systemic

Systemic strategy views the organisation as an open system, taking inputs from society as well as impacting it. The systemic approach involves explicitly considering social forces beyond the organization and its markets and competitors.

The systemic school rests on greater consumer awareness, and greater applications of consumer power. It also stresses that a rational approach cannot always be followed, given increases in consumer power, awareness and expectations. Contemporary aspects such as Corporate Social Responsibility rest on this strategic paradigm.

Whittington's perspectives are founded on altering environmental factors and circumstances, which impact on how managers can devise strategic paths for their organisations. These points are crucial, as an organisation can only make strategy pertinent to its given context and needs. It must thus appraise the best method available to co-ordinate its activities and produce value in its given situation, accounting for its internal and external environment.

The aforecited perspectives also highlight how the business environment has morphed over several decades, from a simple/static environment in the 1950s/60s to a complex and highly changing model at the turn of the century.

General approaches

The two main approaches are opposite but complement each other. The Industrial Organizational approach is based on economic theory and deals with issues such as competition, resource allocation and economies of scale. It assumes rationality and targets profit maximization. The Sociological Approach deals primarily with human interactions and assumes bounded rationality, satisficing behaviour and lower profits. An example of the second approach is Google.

Strategic management can be viewed as bottom-up, top-down, or collaborative. In the bottom-up approach, employees submit proposals to their managers who funnel the best ideas up the ladder. This is often part of a capital budgeting process. Proposals are assessed using financial criteria such as return on investment or cost-benefit analysis. Incorrect estimates of costs and benefits are common errors. Approved proposals implicitly form the substance of the strategy without a strategic design or architect.

The top-down approach is the most common by far. In it, the CEO and the Board of Directors, decides on the overall direction the company should take. The strategy flows down through the organization as each unit adapts to the new approach.

Some organizations employ collaborative techniques that surface new ideas in the process leveraging advances in information technology. It is felt that knowledge management systems should be used to share information and create common goals. Strategic divisions are thought to hamper this process. This notion of strategy has been captured under the rubric of dynamic strategy, popularized by Carpenter and Sanders. This work builds on that of Brown and Eisenhart as well as Christensen and portrays strategic management as the seamless integration of strategy formulation and implementation.

Simulation gaming is a tool for thinking through the ramifications of a particular strategy. Generalized games allow employees to experiment with an unfamiliar environment and try out ways to make decisions in accord with the strategy. Functional games create problematic situations and enable employees to explore ways to address them.

The strategy hierarchy

Most corporations have multiple levels of management. Strategic management can occur at corporate, business, functional and operational levels.

Corporate strategy answers the questions, "which businesses should we be in?" and "how does being in these businesses create synergy and/or add to the competitive advantage of the corporation as a whole?"

Business strategy is the corporate strategy of single firm or a strategic business unit (SBU) in a diversified corporation.

Functional strategies are specific to a functional area, such as marketing, product development, human resources, finance, legal, supply-chain and information technology. The emphasis is on short and medium term plans. Functional strategies are derived from and must comply with broader corporate strategies.

Defining an operational strategy was encouraged by Peter Drucker. It deals with operational activities such as scheduling criteria.

Historical development of strategic management

Origin

The strategic management discipline originated in the 1950s and 1960s. Among the numerous early contributors, the most influential were Alfred Chandler, Philip Selznick, Igor Ansoff, and Peter Drucker. The discipline draws from earlier thinking and texts on 'strategy' dating back thousands of years.

Alfred Chandler recognized the importance of coordinating management activity under an all-encompassing strategy. Interactions between functions were typically handled by managers who relayed information back and forth between departments. Chandler stressed the importance of taking a long term perspective when looking to the future. In his 1962 ground breaking work Strategy and Structure, Chandler showed that a long-term coordinated strategy was necessary to give a company structure, direction and focus. He says it concisely, “structure follows strategy.”

In 1957, Philip Selznick formalized the idea of matching the organization's internal factors with external environmental circumstances. This core idea was developed into what we now call SWOT analysis by Learned, Kenneth R. Andrews, and others at the Harvard Business School General Management Group. Strengths and weaknesses of the firm are assessed in light of the opportunities and threats in the business environment.

Igor Ansoff built on Chandler's work by adding concepts and inventing a vocabulary. He developed a grid that compared strategies for market penetration, product development, market development and horizontal and vertical integration and diversification. He felt that management could use the grid to systematically prepare for the future. In his 1965 classic Corporate Strategy, he developed gap analysis to clarify the gap between the current reality and the goals and to develop what he called “gap reducing actions”.

Peter Drucker was a prolific strategy theorist, author of dozens of management books, with a career spanning five decades. He stressed the value of managing by targeting well-defined objectives. This evolved into his theory of management by objectives (MBO). According to Drucker, the procedure of setting objectives and monitoring progress towards them should permeate the entire organization.

Strategy theorist Michael Porter argued that strategy target either cost leadership, differentiation, or focus. These are known as Porter's three generic strategies and can be applied to any size or form of business. Porter claimed that a company must only choose one of the three or risk that the business would waste precious resources. W. Chan Kim and Renée Mauborgne countered that an organization can achieve high growth and profits by creating a Blue Ocean Strategy that breaks the trade off by pursuing both differentiation and low cost.

In 1985, Ellen-Earle Chaffee summarized what she thought were the main elements of strategic management theory by the 1970s:

- Strategic management involves adapting the organization to its business environment.

- Strategic management is fluid and complex. Change creates novel combinations of circumstances requiring unstructured non-repetitive responses.

- Strategic management affects the entire organization by providing direction.

- Strategic management involves both strategy formation (she called it content) and also strategy implementation (she called it process).

- Strategic management is partially planned and partially unplanned.

- Strategic management is done at several levels: overall corporate strategy, and individual business strategies.

- Strategic management involves both conceptual and analytical thought processes.

Growth and portfolio theory

In the 1970s much of strategic management dealt with size, growth, and portfolio theory. The long-term PIMS study, started in the 1960s and lasting for 19 years, attempted to understand the Profit Impact of Marketing Strategies (PIMS), particularly the effect of market share. It started at General Electric, moved to Harvard in the early 1970s, and then moved to the Strategic Planning Institute in the late 1970s. It now contains decades of information on the relationship between profitability and strategy. Their initial conclusion was unambiguous: the greater a company's market share, the greater their rate of profit. Market share provides economies of scale. It also provides experience curve advantages. The combined effect is increased profits.

The benefits of high market share naturally led to an interest in growth strategies. The relative advantages of horizontal integration, vertical integration, diversification, franchises, mergers and acquisitions, joint ventures and organic growth were discussed.

Other research indicated that a low market share strategy could still be very profitable. Schumacher (1973), Woo and Cooper (1982), Levenson (1984), and later Traverso (2002)[17] showed how smaller niche players obtained very high returns.

By the early 1980s the paradoxical conclusion was that high market share and low market share companies were often very profitable but most of the companies in between were not. This was sometimes called the “hole in the middle” problem. Porter explained this anomaly in the 1980s.

The management of diversified organizations required additional techniques and ways of thinking. The first CEO to address the problem of a multi-divisional company was Alfred Sloan at General Motors. GM employed semi-autonomous “strategic business units” (SBU's), with centralized support functions.

One of the most valuable concepts in the strategic management of multi-divisional companies was portfolio theory. In the previous decade Harry Markowitz and other financial theorists developed modern portfolio theory. They concluded that a broad portfolio of financial assets could reduce specific risk. In the 1970s marketers extended the theory to product portfolio decisions and managerial strategists extended it to operating division portfolios. Each of a company’s operating divisions were seen as an element in the firm's portfolio. Each operating division was treated as a semi-independent profit center with its own revenues, costs, objectives and strategies.

Several techniques were developed to analyze the relationships between elements in a portfolio. B.C.G. Analysis, for example, was developed by the Boston Consulting Group in the early 1970s. Shortly after that the G.E. multi factoral model was developed by General Electric. Companies continued to diversify until the 1980s when it was realized that in many cases a portfolio of operating divisions was worth more as separate completely independent companies.

Move from sales focus to marketing

The 1970s also saw the rise of the marketing oriented firm. From the beginnings of capitalism it was assumed that the key requirement of business success was a product of high technical quality. If you produced a product that worked well and was durable, it was assumed you would have no difficulty profiting. This was called the production orientation. The 1950s and 1960s was described as the "sales era". Its guiding philosophy of business is today called the "sales orientation". In the early 1970s Theodore Levitt and others at Harvard argued that the sales orientation had things backward. They claimed that instead of producing products then trying to sell them to the customer, businesses should start with the customer, find out what they wanted, and then produce it for them. The customer became the driving force behind all strategic business decisions. This marketing concept, in the decades since its introduction, has been reformulated and repackaged under names including market orientation, customer orientation, customer intimacy, customer focus, customer-driven and market focus.

The Japanese challenge

In 2009, industry consultants Mark Blaxill and Ralph Eckardt suggested that much of the Japanese business dominance that began in the mid-1970s was the direct result of competition enforcement efforts by the U.S. Federal Trade Commission (FTC) and U.S. Department of Justice (DOJ). In 1975, under the direction of Frederic M. Scherer, the FTC settled its anti-trust lawsuit against Xerox Corporation. The consent decree forced the licensing of the company’s entire patent portfolio, mainly to Japanese competitors. This action marked the start of an activist approach to managing competition by FTC and DOJ, which resulted in the compulsory licensing of tens of thousands of patent from some of America's leading companies, including IBM, AT&T Corporation, DuPont, Bausch & Lomb and Eastman Kodak.

Within four years of the consent decree, Xerox's share of the U.S. copier market dropped from nearly 100% to less than 14%. Between 1950 and 1980 Japanese companies consummated more than 35,000 foreign licensing agreements, mostly with U.S. companies, for free or low-cost licenses made possible by the FTC and DOJ. The post-1975 era of anti-trust initiatives by Washington D.C. economists at the FTC corresponded directly with the rapid, unprecedented rise in Japanese competitiveness and a simultaneous stalling of the U.S. manufacturing economy.

Competitive advantage

Japanese successes shook the confidence of the western business elite, but detailed comparisons of the two management styles and examinations of successful businesses convinced westerners that they could overcome the threat. The 1980s and early 1990s produced theories explaining exactly how this could be done. They cannot all be detailed here, but some of the more important strategic advances of the decade are explained below.

Gary Hamel and C. K. Prahalad declared that strategy needs to be more active and interactive; less “arm-chair planning” was needed. Their most well known advance was the idea of core competency, the idea that each organization has some functional area in which it excels and that the business should focus on opportunities in that area, letting others go.

Active strategic management required active information gathering and active problem solving. In the early days of Hewlett-Packard (HP), Dave Packard and Bill Hewlett devised an active management style that they called management by walking around (MBWA). Senior HP managers were seldom at their desks. They spent most of their days visiting employees, customers, and suppliers. This direct contact with key people provided them with a solid grounding from which viable strategies could be crafted. management consultants Tom Peters and Robert H. Waterman had used the term in their 1982 book In Search of Excellence: lessons from America's best-run companies. Some Japanese managers employ a similar system, which originated at Honda, and is sometimes called the 3 G's (Genba, Genbutsu, and Genjitsu, which translate into “actual place”, “actual thing”, and “actual situation”).

Probably the most influential strategist of the decade was Michael Porter. He introduced many new concepts including; 5 forces analysis, generic strategies, the value chain, strategic groups and clusters. In 5 forces analysis he identified the forces that shape the strategic environment. It is like a SWOT analysis with structure and purpose. It shows how a firm can use these forces to obtain a sustainable competitive advantage. Porter modifies Chandler's dictum about structure following strategy by introducing a second level of structure: while organizational structure follows strategy, it in turn follows industry structure. Porter's generic strategies detail the interaction between cost minimization strategies, product differentiation strategies, and market focus strategies. Although he did not introduce these terms, he showed the importance of choosing one of them rather than trying to position your company between them. He also challenged managers to see their industry in terms of a value chain. A firm will be successful only to the extent that it contributes to its industry's value chain. This forced management to look at its operations from the customer's point of view.

In 1993, John Kay expressed the value chain concept in financial terms, claiming “Adding value is the central purpose of business activity”, where the value added is the difference between the market value of outputs and the cost of inputs including capital, all divided by the firm's net output. Borrowing from Hamel and Porter, Kay claimed that the role of strategic management is to identify core competencies, and then assemble assets that will increase value added and provide a competitive advantage. He claimed that there are 3 types of capabilities that can do this; innovation, reputation and organizational structure.

The 1980s also saw the widespread acceptance of positioning theory. Although the theory originated with Jack Trout in 1969, it didn’t gain wide acceptance until Al Ries and Jack Trout wrote their classic book “Positioning: The Battle For Your Mind” (1979). The basic premise is that a strategy should not be judged by internal company factors but by the way customers see it relative to the competition. Crafting and implementing a strategy involves creating a position in the mind of the collective consumer. Several techniques enabled the practical use of positioning theory. Perceptual mapping for example, creates visual displays of the relationships between positions. Multidimensional scaling, discriminant analysis, factor analysis and conjoint analysis are mathematical techniques used to determine the most relevant characteristics (called dimensions or factors) upon which positions should be based. Preference regression can be used to determine vectors of ideal positions and cluster analysis can identify clusters of positions.

In 1992 Jay Barney saw strategy as assembling the optimum mix of resources, including human, technology and suppliers, and then configuring them in unique and sustainable ways.[23]

Michael Hammer and James Champy felt that these resources needed to be restructured.[24] In a process that they labeled reengineering, firm's reorganized their assets around whole processes rather than tasks. In this way a team of people saw a project through, from inception to completion. This avoided functional silos where isolated departments seldom talked to each other. It also eliminated waste due to functional overlap and interdepartmental communications.

In 1989 Richard Lester and the researchers at the MIT Industrial Performance Center identified seven best practices and concluded that firms must accelerate the shift away from the mass production of low cost standardized products. The seven areas of best practice were:

Simultaneous continuous improvement in cost, quality, service, and product innovation

Breaking down organizational barriers between departments

Eliminating layers of management creating flatter organizational hierarchies.

Closer relationships with customers and suppliers

Intelligent use of new technology

Global focus

Improving human resource skills

The search for “best practices” is also called benchmarking. This involves determining where you need to improve, finding an organization that is exceptional in this area, then studying the company and applying its best practices in your firm.

A large group of theorists felt the area where western business was most lacking was product quality. W. Edwards Deming, Joseph M. Juran, A. Kearney, Philip Crosby and Armand Feignbaum suggested quality improvement techniques such total quality management (TQM), continuous improvement (kaizen), lean manufacturing, Six Sigma, and return on quality (ROQ).

Contrarily, James Heskett (1988), Earl Sasser (1995), William Davidow, Len Schlesinger, A. Paraurgman (1988), Len Berry, Jane Kingman-Brundage, Christopher Hart, and Christopher Lovelock (1994), felt that poor customer service was the problem. They gave us fishbone diagramming, service charting, Total Customer Service (TCS), the service profit chain, service gaps analysis, the service encounter, strategic service vision, service mapping, and service teams. Their underlying assumption was that there is no better source of competitive advantage than a continuous stream of delighted customers.

Process management uses some of the techniques from product quality management and some of the techniques from customer service management. It looks at an activity as a sequential process. The objective is to find inefficiencies and make the process more effective. Although the procedures have a long history, dating back to Taylorism, the scope of their applicability has been greatly widened, leaving no aspect of the firm free from potential process improvements. Because of the broad applicability of process management techniques, they can be used as a basis for competitive advantage.

Carl Sewell, Frederick F. Reichheld, C. Gronroos, and Earl Sasser observed that businesses were spending more on customer acquisition than on retention. They showed how a competitive advantage could be found in ensuring that customers returned again and again. Reicheld broadened the concept to include loyalty from employees, suppliers, distributors and shareholders. They developed techniques for estimating customer lifetime value (CLV) for assessing long-term relationships. The concepts begat attempts to recast selling and marketing into a long term endeavor that created a sustained relationship (called relationship selling, relationship marketing, and customer relationship management). Customer relationship management (CRM) software became integral to many firms.

James Gilmore and Joseph Pine found competitive advantage in mass customization. Flexible manufacturing techniques allowed businesses to individualize products for each customer without losing economies of scale. This effectively turned the product into a service. They also realized that if a service is mass-customized by creating a “performance” for each individual client, that service would be transformed into an “experience”. Their book, The Experience Economy, along with the work of Bernd Schmitt convinced many to see service provision as a form of theatre. This school of thought is sometimes referred to as customer experience management (CEM).

Like Peters and Waterman a decade earlier, James Collins and Jerry Porras spent years conducting empirical research on what makes great companies. Six years of research uncovered a key underlying principle behind the 19 successful companies that they studied: They all encourage and preserve a core ideology that nurtures the company. Even though strategy and tactics change daily, the companies, nevertheless, were able to maintain a core set of values. These core values encourage employees to build an organization that lasts. In Built To Last (1994) they claim that short term profit goals, cost cutting, and restructuring will not stimulate dedicated employees to build a great company that will endure. In 2000 Collins coined the term “built to flip” to describe the prevailing business attitudes in Silicon Valley. It describes a business culture where technological change inhibits a long term focus. He also popularized the concept of the BHAG (Big Hairy Audacious Goal).

Arie de Geus (1997) undertook a similar study and obtained similar results. He identified four key traits of companies that had prospered for 50 years or more. They are:

Sensitivity to the business environment — the ability to learn and adjust

Cohesion and identity — the ability to build a community with personality, vision, and purpose

Tolerance and decentralization — the ability to build relationships

Conservative financing

A company with these key characteristics he called a living company because it is able to perpetuate itself. If a company emphasizes knowledge rather than finance, and sees itself as an ongoing community of human beings, it has the potential to become great and endure for decades. Such an organization is an organic entity capable of learning (he called it a “learning organization”) and capable of creating its own processes, goals, and persona.

Will Mulcaster suggests that firms engage in a dialogue that centres around these questions:

Will the proposed competitive advantage create Perceived Differential Value?"

Will the proposed competitive advantage create something that is different from the competition?"

Will the difference add value in the eyes of potential customers?" – This question will entail a discussion of the combined effects of price, product features and consumer perceptions.

Will the product add value for the firm?" – Answering this question will require an examination of cost effectiveness and the pricing strategy.

Military strategy

In the 1980s business strategists realized that there was a vast knowledge base stretching back thousands of years that they had barely examined. They turned to military strategy for guidance. Military strategy books such as The Art of War by Sun Tzu, On War by von Clausewitz, and The Red Book by Mao Zedong became business classics. From Sun Tzu, they learned the tactical side of military strategy and specific tactical prescriptions. From von Clausewitz, they learned the dynamic and unpredictable nature of military action. From Mao, they learned the principles of guerrilla warfare. Important marketing warfare books include Business War Games by Barrie James, Marketing Warfare by Al Ries and Jack Trout and Leadership Secrets of Attila the Hun by Wess Roberts.

The four types of business warfare theories are:

Offensive marketing warfare strategies

Defensive marketing warfare strategies

Flanking marketing warfare strategies

Guerrilla marketing warfare strategies

The marketing warfare literature also examined leadership and motivation, intelligence gathering, types of marketing weapons, logistics and communications.

By the twenty-first century marketing warfare strategies had gone out of favour in favor of non-confrontational approaches. In 1989, Dudley Lynch and Paul L. Kordis published Strategy of the Dolphin: Scoring a Win in a Chaotic World. "The Strategy of the Dolphin” was developed to give guidance as to when to use aggressive strategies and when to use passive strategies. A variety of aggressiveness strategies were developed.

In 1993, J. Moore used a similar metaphor. Instead of using military terms, he created an ecological theory of predators and prey(see ecological model of competition), a sort of Darwinian management strategy in which market interactions mimic long term ecological stability.

Strategic change

In 1969, Peter Drucker coined the phrase Age of Discontinuity to describe the way change disrupts lives.[46] In an age of continuity attempts to predict the future by extrapolating from the past can be accurate. But according to Drucker, we are now in an age of discontinuity and extrapolating is ineffective. He identifies four sources of discontinuity: new technologies, globalization, cultural pluralism and knowledge capital.

In 1970, Alvin Toffler in Future Shock described a trend towards accelerating rates of change. He illustrated how social and technical phenomena had shorter lifespans with each generation, and he questioned society's ability to cope with the resulting turmoil and accompanying anxiety. In past eras periods of change were always punctuated with times of stability. This allowed society to assimilate the change before the next change arrived. But these periods of stability had all but disappeared by the late 20th century. In 1980 in The Third Wave, Toffler characterized this shift to relentless change as the defining feature of the third phase of civilization (the first two phases being the agricultural and industrial waves).

In 1978, Dereck Abell (Abell, D. 1978) described "strategic windows" and stressed the importance of the timing (both entrance and exit) of any given strategy. This led some strategic planners to build planned obsolescence into their strategies.

n 1983, Noel Tichy wrote that because we are all beings of habit we tend to repeat what we are comfortable with. He wrote that this is a trap that constrains our creativity, prevents us from exploring new ideas, and hampers our dealing with the full complexity of new issues. He developed a systematic method of dealing with change that involved looking at any new issue from three angles: technical and production, political and resource allocation, and corporate culture.

Peters and Austin (1985) stressed the importance of nurturing champions and heroes. They said we have a tendency to dismiss new ideas, so to overcome this, we should support those few people in the organization that have the courage to put their career and reputation on the line for an unproven idea.

In 1988, Henry Mintzberg looked at the changing world around him and decided it was time to reexamine how strategic management was done. He examined the strategic process and concluded it was much more fluid and unpredictable than people had thought. Because of this, he could not point to one process that could be called strategic planning. Instead Mintzberg concludes that there are five types of strategies:

- Strategy as plan – a direction, guide, course of action – intention rather than actual

- Strategy as ploy – a maneuver intended to outwit a competitor

- Strategy as pattern – a consistent pattern of past behaviour – realized rather than intended

- Strategy as position – locating of brands, products, or companies within the conceptual framework of consumers or other stakeholders – strategy determined primarily by factors outside the firm

- Strategy as perspective – strategy determined primarily by a master strategist

In 1998, Mintzberg developed these five types of management strategy into 10 “schools of thought” and grouped them into three categories. The first group is normative. It consists of the schools of informal design and conception, the formal planning, and analytical positioning. The second group, consisting of six schools, is more concerned with how strategic management is actually done, rather than prescribing optimal plans or positions. The six schools are entrepreneurial, visionary, cognitive, learning/adaptive/emergent, negotiation, corporate culture and business environment. The third and final group consists of one school, the configuration or transformation school, a hybrid of the other schools organized into stages, organizational life cycles, or “episodes”.

In 1989, Charles Handy identified two types of change.[54] "Strategic drift" is a gradual change that occurs so subtly that it is not noticed until it is too late. By contrast, "transformational change" is sudden and radical. It is typically caused by discontinuities (or exogenous shocks) in the business environment. The point where a new trend is initiated is called a "strategic inflection point" by Andy Grove. Inflection points can be subtle or radical.

In 1990, Richard Pascale (Pascale, R. 1990) wrote that relentless change requires that businesses continuously reinvent themselves. His famous maxim is “Nothing fails like success” by which he means that what was a strength yesterday becomes the root of weakness today, We tend to depend on what worked yesterday and refuse to let go of what worked so well for us in the past. Prevailing strategies become self-confirming. To avoid this trap, businesses must stimulate a spirit of inquiry and healthy debate. They must encourage a creative process of self-renewal based on constructive conflict.

In 1996, Adrian Slywotzky showed how changes in the business environment are reflected in value migrations between industries, between companies, and within companies. He claimed that recognizing the patterns behind these value migrations is necessary if we wish to understand the world of chaotic change. In “Profit Patterns” (1999) he described businesses as being in a state of strategic anticipation as they try to spot emerging patterns. Slywotsky and his team identified 30 patterns that have transformed industry after industry.

In 1997, Clayton Christensen (1997) took the position that great companies can fail precisely because they do everything right since the capabilities of the organization also define its disabilities. Christensen's thesis is that outstanding companies lose their market leadership when confronted with disruptive technology. He called the approach to discovering the emerging markets for disruptive technologies agnostic marketing, i.e., marketing under the implicit assumption that no one – not the company, not the customers – can know how or in what quantities a disruptive product can or will be used without the experience of using it.

In 1999, Constantinos Markides reexamined the nature of strategic planning. He described strategy formation and implementation as an on-going, never-ending, integrated process requiring continuous reassessment and reformation. Strategic management is planned and emergent, dynamic and interactive.

J. Moncrieff (1999) stressed strategy dynamics. He claimed that strategy is partially deliberate and partially unplanned. The unplanned element comes from emergent strategies that result from the emergence of opportunities and threats in the environment and from "strategies in action" (ad hoc actions across the organization).

David Teece pioneered research on resource-based strategic management and the dynamic capabilities perspective, defined as “the ability to integrate, build, and reconfigure internal and external competencies to address rapidly changing environments".[61] His 1997 paper (with Gary Pisano and Amy Shuen) "Dynamic Capabilities and Strategic Management" was the most cited paper in economics and business for the period from 1995 to 2005.

In 2000, Gary Hamel discussed strategic decay, the notion that the value of every strategy, no matter how brilliant, decays over time.

In 2000, Malcolm Gladwell discussed the importance of the tipping point, that point where a trend or fad acquires critical mass and takes off.

A number of strategists use scenario planning techniques to deal with change. The way Peter Schwartz put it in 1991 is that strategic outcomes cannot be known in advance so the sources of competitive advantage cannot be predetermined. The fast changing business environment is too uncertain for us to find sustainable value in formulas of excellence or competitive advantage. Instead, scenario planning is a technique in which multiple outcomes can be developed, their implications assessed, and their likeliness of occurrence evaluated. According to Pierre Wack, scenario planning is about insight, complexity, and subtlety, not about formal analysis and numbers.

Some business planners are starting to use a complexity theory approach to strategy. Complexity can be thought of as chaos with a dash of order. Chaos theory deals with turbulent systems that rapidly become disordered. Complexity is not quite so unpredictable. It involves multiple agents interacting in such a way that a glimpse of structure may appear.

Information- and technology-driven strategy

Peter Drucker conceived of the “knowledge worker” in the 1950s. He described how fewer workers would do physical labor, and more would apply their minds. In 1984, John Naisbitt theorized that the future would be driven largely by information: companies that managed information well could obtain an advantage, however the profitability of what he called “information float” (information that the company had and others desired) would disappear as inexpensive computers made information more accessible.

Daniel Bell (1985) examined the sociological consequences of information technology, while Gloria Schuck and Shoshana Zuboff looked at psychological factors. Zuboff distinguished between “automating technologies” and “infomating technologies”. She studied the effect that both had on workers, managers and organizational structures. She largely confirmed Drucker's predictions about the importance of flexible decentralized structure, work teams, knowledge sharing and the knowledge worker's central role. Zuboff also detected a new basis for managerial authority, based on knowledge (also predicted by Drucker) which she called “participative management”.

In 1990, Peter Senge, who had collaborated with Arie de Geus at Dutch Shell, popularized de Geus' notion of the "learning organization". The theory is that gathering and analyzing information is a necessary requirement for business success in the information age. To do this, Senge claimed that an organization would need to be structured such that:

- People can continuously expand their capacity to learn and be productive.

- New patterns of thinking are nurtured.

- Collective aspirations are encouraged.

- People are encouraged to see the “whole picture” together.

Senge identified five disciplines of a learning organization. They are:

Personal responsibility, self-reliance, and mastery — We accept that we are the masters of our own destiny. We make decisions and live with the consequences of them. When a problem needs to be fixed, or an opportunity exploited, we take the initiative to learn the required skills to get it done.

Mental models — We need to explore our personal mental models to understand the subtle effect they have on our behaviour.

Shared vision — The vision of where we want to be in the future is discussed and communicated to all. It provides guidance and energy for the journey ahead.

Team learning — We learn together in teams. This involves a shift from “a spirit of advocacy to a spirit of enquiry”.

Systems thinking — We look at the whole rather than the parts. This is what Senge calls the “Fifth discipline”. It is the glue that integrates the other four into a coherent strategy. For an alternative approach to the “learning organization”, see Garratt, B. (1987).

Geoffrey Moore (1991) and R. Frank and P. Cook also detected a shift in the nature of competition. Markets driven by technical standards or by "network effects" can give the dominant firm a near-monopoly. The same is true of networked industries in which interoperability requires compatibility between users. Examples include Internet Explorer's and Amazon's early dominance of their respective industries. IE's later decline shows that such dominance may be only temporary.

Moore showed how firms could attain this enviable position by using E.M. Rogers' five stage adoption process and focusing on one group of customers at a time, using each group as a base for reaching the next group. The most difficult step is making the transition between introduction and mass acceptance. (See Crossing the Chasm). If successful a firm can create a bandwagon effect in which the momentum builds and its product becomes a de facto standard.

Many industries with a high information component are being transformed. For example, Encarta demolished Encyclopædia Britannica (whose sales have plummeted 80% since their peak of $650 million in 1990) before it was in turn, eclipsed by collaborative encyclopedias like Wikipedia. The music industry was similarly disrupted. The technology sector has provided some strategies directly. For example, from the software development industry agile software development provides a model for shared development processes.

Information systems allow managers to take a much more analytical view of their business than before. One such system is the balanced scorecard. It measures financial, marketing, production, organizational development, and new product development factors to achieve a 'balanced' perspective.

Strategic decision making processes

Will Mulcaster argued that while much research and creative thought has been devoted to generating alternative strategies, too little work has been done on what influences the quality of strategic decision making and the effectiveness with which strategies are implemented. For instance, in retrospect it can be seen that the financial crisis of 2008–9 could have been avoided if the banks had paid more attention to the risks associated with their investments, but how should banks change the way they make decisions to improve the quality of their decisions in the future? Mulcaster's Managing Forces framework addresses this issue by identifying 11 forces that should be incorporated into the processes of decision making and strategic implementation. The 11 forces are: Time; Opposing forces; Politics; Perception; Holistic effects; Adding value; Incentives; Learning capabilities; Opportunity cost; Risk and Style.

Question book-new.svg

This article does not cite any references or sources. Please help improve this article by adding citations to reliable sources. Unsourced material may be challenged and removed. (December 2009)

International Strategic Management

International Strategic Management (ISM) is an ongoing management planning process aimed at developing strategies to allow an organization to expand abroad and compete internationally. Strategic planning is used in the process of developing a particular international strategy.

An organization must be able to determine what products or services they intend to sell, where and how the organization will make these products or services, where they will sell them, and how the organization will acquire the necessary resources for these tasks. Even more importantly an organization must have a strategy on how it expects to outperform its competitors.

Development complexity

When an organization moves from being a domestic entity to an international organization it must consider the possible broad complexities that accompany such a decision. In a domestic country, an organization must only consider one national government, a single currency and accounting system, one political and legal system, and usually a similar culture. Entering into one or more foreign countries can involve multiple governments, currencies, accounting systems, legal systems, and a large variety of languages and cultures. This can create numerous barriers to entry for an organization looking to expand internationally.

Basic questions

In foreign countries, there are the possibilities of:

local languages required in many situations.

inadequate or limited communication.

very diverse cultures, both between countries and sometimes even within countries.

often volatile politics.

varied economic systems.

scarcity of skilled labor, with possible costs in training labor or redesigning procedures.

poorly-developed financial markets and government-controlled capital flows, in some of the countries.

problems and exorbitant costs in obtaining market research data.

limited advertising, subjected to lots of restrictions.

possible low literacy rates, not to mention the possibility of making mistakes in the language when advertising.

currency exchange fluctuations.

mandatory worker participation in management in some countries.

legal restrictions on laying off of workers.

Non-strategic management

A 1938 treatise by Chester Barnard, based on his own experience as a business executive, described the process as informal, intuitive, non-routinized and involving primarily oral, 2-way communications. Bernard says “The process is the sensing of the organization as a whole and the total situation relevant to it. It transcends the capacity of merely intellectual methods, and the techniques of discriminating the factors of the situation. The terms pertinent to it are “feeling”, “judgement”, “sense”, “proportion”, “balance”, “appropriateness”. It is a matter of art rather than science.”

In 1973, Mintzberg found that senior managers typically deal with unpredictable situations so they strategize in ad hoc, flexible, dynamic, and implicit ways. He wrote, “The job breeds adaptive information-manipulators who prefer the live concrete situation. The manager works in an environment of stimulous-response, and he develops in his work a clear preference for live action.”[75]

In 1982, John Kotter studied the daily activities of 15 executives and concluded that they spent most of their time developing and working a network of relationships that provided general insights and specific details for strategic decisions. They tended to use “mental road maps” rather than systematic planning techniques.

Daniel Isenberg's 1984 study of senior managers found that their decisions were highly intuitive. Executives often sensed what they were going to do before they could explain why. He claimed in 1986 that one of the reasons for this is the complexity of strategic decisions and the resultant information uncertainty.

Zuboff claimed that information technology was widening the divide between senior managers (who typically make strategic decisions) and operational level managers (who typically make routine decisions). She alleged that prior to the widespread use of computer systems, managers, even at the most senior level, engaged in both strategic decisions and routine administration, but as computers facilitated (She called it “deskilled”) routine processes, these activities were moved further down the hierarchy, leaving senior management free for strategic decision making.

In 1977, Abraham Zaleznik distinguished leaders from managers. He described leaders as visionaries who inspire, while managers care about process. He claimed that the rise of managers was the main cause of the decline of American business in the 1970s and 1980s. Lack of leadership is most damaging at the level of strategic management where it can paralyze an entire organization.

Dr. Maretha Prinsloo developed the Cognitive Process Profile (CPP) psychometric from the work of Elliott Jacques. The CPP is a computer based psychometric which profiles a person's capacity for strategic thinking. It is used worldwide in selecting and developing people for strategic roles.

According to Corner, Kinichi, and Keats,[81] strategic decision making in organizations occurs at two levels: individual and aggregate. They developed a model of parallel strategic decision making. The model identifies two parallel processes that involve getting attention, encoding information, storage and retrieval of information, strategic choice, strategic outcome and feedback. The individual and organizational processes interact at each stage. For instance, competition-oriented objectives are based on the knowledge of competing firms, such as their market share.

Limitations of strategic management

In 2000, Gary Hamel coined the term strategic convergence to explain the limited scope of the strategies being used by rivals in greatly differing circumstances. He lamented that successful strategies are imitated by firms that do not understand that for a strategy for the specifics of each situation.

But in the world where strategies must be implemented, the three elements are interdependent. Means are as likely to determine ends as ends are to determine means. The objectives that an organization might wish to pursue are limited by the range of feasible approaches to implementation. (There will usually be only a small number of approaches that will not only be technically and administratively possible, but also satisfactory to the full range of organizational stakeholders.) In turn, the range of feasible implementation approaches is determined by the availability of resources.

Another critique of strategic management is that it can overly constrains managerial discretion in a dynamic environment. "How can individuals, organizations and societies cope as well as possible with ... issues too complex to be fully understood, given the fact that actions initiated on the basis of inadequate understanding may lead to significant regret?"

Some theorists insist on an iterative approach, considering in turn objectives, implementation and resources. I.e., a "...repetitive learning cycle [rather than] a linear progression towards a clearly defined final destination." Strategies must be able to adjust during implementation because "humans rarely can proceed satisfactorily except by learning from experience; and modest probes, serially modified on the basis of feedback, usually are the best method for such learning."

Woodhouse and Collins claim that the essence of being “strategic” lies in a capacity for "intelligent trial-and error" rather than strict adherence to finely-honed strategic plans. Strategy should be seen as laying out the general path rather than precise steps.

"Creative" vs. analytic approaches

In 2010, IBM released a study summarizing three conclusions of 1.500 CEOs around the world: 1) complexity is escalating, 2) enterprises are not equipped to cope with this complexity, and 3) creativity is now the single most important leadership competency. IBM said that it is needed in all aspects of leadership, including strategic thinking and planning.